What is a Bitcoin Exchange?

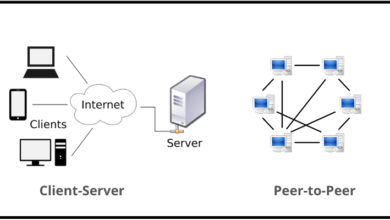

Bitcoin was created to facilitate cash-like peer-to-peer value exchange in the digital space. This implies that you may exchange bitcoin for anything you want, directly, without going through a middleman like a bank or a payment service.

If someone paints your house, for instance, you may agree to send them a specific quantity of bitcoin as payment. In reality, this wouldn’t be much different from paying cash for the house-painting service.

What’s Liquidity?

The ease with which you may purchase and sell an item is referred to as liquidity, and it mostly depends on how many buyers and sellers (market participants) there are for that asset. Since it is virtually universally acknowledged, cash is often regarded as the asset with the greatest liquidity.

In other words, it’s simple to swap money for almost anything you choose. In contrast to cash, a car is often a less liquid asset since it takes some work to locate a buyer. In contrast, a high-end collector’s automobile would be an even less liquid asset because there are fewer possible purchasers.

What’s a Bitcoin Exchange?

Any service that connects bitcoin buyers and sellers is a bitcoin exchange. Bitcoin is a liquid asset for large-scale traders thanks to exchanges.

Most people refer to centralized “custodial” systems like Coinbase, Kraken, and Binance when they talk about bitcoin exchanges. These online marketplaces make it easier to exchange cryptocurrencies like bitcoin and many others. Exchanges for cryptocurrencies connect buyers and sellers, just way stock trading platforms like Charles Schwab and Robinhood do.

Importantly, a centralized cryptocurrency exchange takes possession of your bitcoin by definition. This has a variety of ramifications for security, as well as for your ability to utilize bitcoin however you see fit.

How Do Centralized Bitcoin Exchanges Work?

From the viewpoint of the user, the usual flow looks like this:

- Join the exchange and provide identification papers.

- Your freshly established account can be funded with bitcoin, another cryptocurrency, or local money if the exchange accepts it.

- Set a “purchase order” to make a deal.

To efficiently and automatically match buyers and sellers, the exchange compiles buy and sell orders into an “order book” that it keeps up to date. You may often set both “market buy” and “limit buys” orders on exchanges.

You don’t choose the price when you place a market buy order; you just need to specify how much bitcoin you want to purchase. The exchange will carry out your deal by automatically matching you with the seller(s) who are presently providing the lowest price. Market orders are often promptly fulfilled, so as soon as you place the purchase, your bitcoin will appear in your exchange wallet or account.

You specify how much bitcoin you want to purchase and the price you’re ready to pay when you place a limit buy order. Your order will succeed if and when there are sellers prepared to accept the price you’ve specified (your “limit”), at which point your money (or other cryptocurrencies) will vanish and your bitcoin will appear in your exchange wallet.